Pricing & Risk Analytics SDK

The industry’s most trusted pricing analytics

Financial organizations around the globe rely on FINCAD Analytics for valuation of derivatives and fixed income instruments. Using our powerful Analytics SDK, you can integrate FINCAD Analytics into front-office portfolio management systems, treasury systems, real-time pricing tools, enterprise-wide risk management systems, simulation and modeling systems, trading systems and various other applications.

You also have the flexibility to access your valuation solution in a variety of different ways using FINCAD’s proven technology. Learn about our Microsoft Excel and Python solutions.

Flexible software solutions for you and your firm

- Get mark-to-market values of positions and portfolios

- Do risk analysis and reporting

- Validate models

- Perform scenario analysis, stress testing and cash flow analysis

- Assess counterparty exposure

- Calculate value-at-risk

Discover how one quantitative hedge fund is using FINCAD's SDK to run high frequency backtests of their trading and investment strategies.

Quantitative Hedge Fund - Case Study

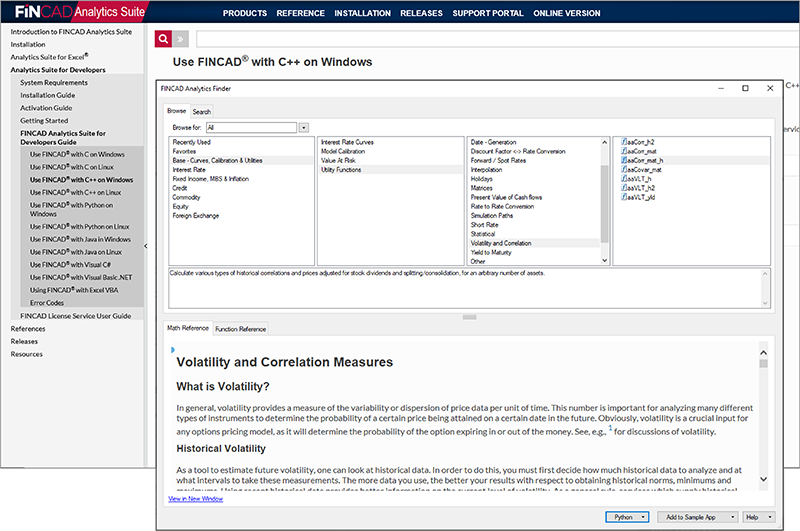

Unmatched User Experience

With Analytics Finders, extensive developer documentation directories, comprehensive sample code in all supported languages, sample application integration tools and rich error handling controls within the library guarantee seamless integration and robust applications.

Rapidly prototype, validate, build and test your financial application and workflows using FINCAD Analytics Suite for Excel.

Extensive Coverage

Get out-of-the-box coverage for vanilla, structured and exotic instruments across all major asset classes using industry standard models, supported by comprehensive curve-building and model calibration. Calculate risk and implied equivalent metrics. Plus, use building blocks to configure customized trade types and analysis workflows.

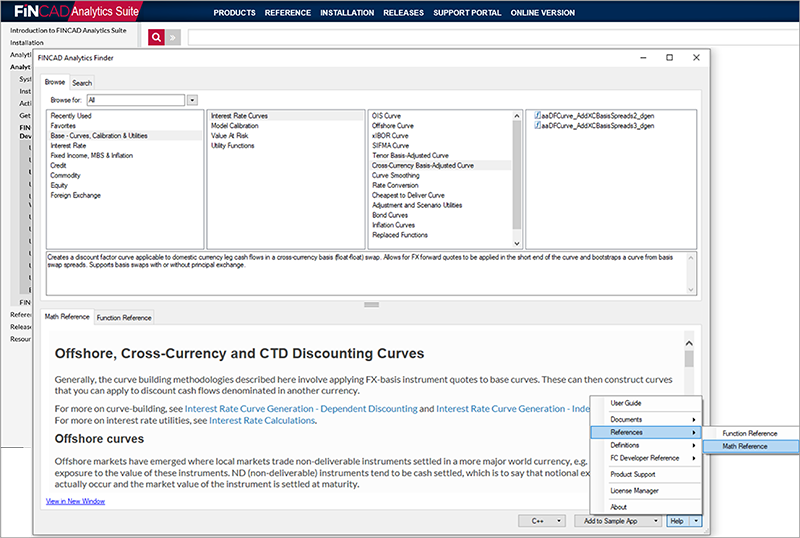

Complete Transparency

Where others offer black box solutions, our priority is superior analytics without compromising transparency and tractability.

Access comprehensive documentation describing instruments structurally, all the way down to the mathematical formulas used in each calculation. With FINCAD, you’ll have utmost confidence in the math and models underlying your valuation and risk.

Development Platforms and Production Environments

FINCAD Analytics SDK easily integrates into your programing environment with thread safe APIs that support various programming languages and operating systems:

- Operating Systems: MS Windows®, Linux®

- Programming Languages: JavaTM, Microsoft® VBA, C and C++, Managed C++, VB.Net, C#, Python

With FINCAD runtime libraries and tools, you can quickly and easily deploy your solution to traditional server-based systems or to distributed cloud-based services.