It’s hard to believe that we are now a decade on from the nadir of the financial crisis and the collapse of Lehman Brothers. A big difference between now and then is the extent to which the terms ‘ABS’ and ‘MBS’ have entered the common parlance and consciousness. Both, with some justification, have been cited as being central antagonists for their role in bringing the world to the brink of a financial apocalypse ten years ago. Nonetheless institutional investors, perhaps with blissfully short memories or more likely in their voracious appetite for yield, are undiminished in their appetite for these securities.

It’s hard to believe that we are now a decade on from the nadir of the financial crisis and the collapse of Lehman Brothers. A big difference between now and then is the extent to which the terms ‘ABS’ and ‘MBS’ have entered the common parlance and consciousness. Both, with some justification, have been cited as being central antagonists for their role in bringing the world to the brink of a financial apocalypse ten years ago. Nonetheless institutional investors, perhaps with blissfully short memories or more likely in their voracious appetite for yield, are undiminished in their appetite for these securities.

The casual observer may be perturbed by this. Unpicking the causal factors of the crash, reams of retrospective research has identified that an asset bubble had formed in the structured credit market. The twin drivers of systematic mispricing/misrepresentation of risk and irrational exuberance fuelled demand and sustained the bubble in banks that were poorly capitalised and weakly regulated. Mortgages that were packaged up as ‘AAA’ ABS tranches unravelled as the first delinquencies collapsed the house of cards that the era of cheap credit had sustained itself on.

Recidivism certainly can extend to the realm of professional investing. However, one can be cautiously optimistic that the structural factors contributing to the 2008 crash have been somewhat contained by the raft of new regulatory and legislative controls that are now in force. Indeed, it would no longer seem to be the inability of creditors to pay their dues that is keeping institutional investors awake at night – in fact quite the opposite.

Prepayment risk describes the circumstances when debtors elect to return principal earlier than may have been anticipated, reducing or even cancelling anticipated interest payments. For lenders, this can lead to unforeseen disruption in their cash flow management and windfall losses/profits dependant on lending conditions. In either case, the uncertainty created by pre-payment needs to be factored into investment decision-making.

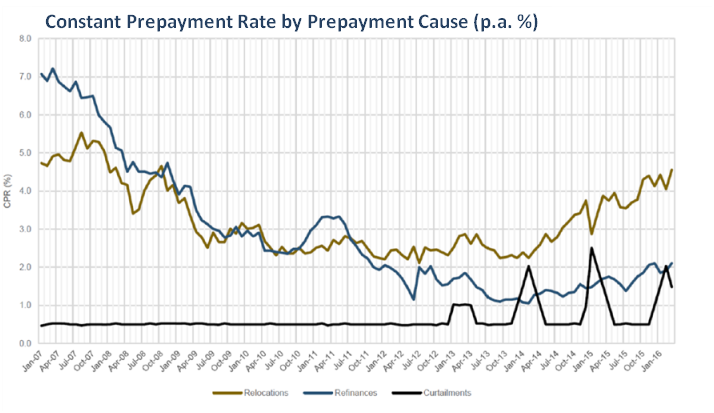

So how does prepayment risk manifest itself and how do we model it? Academics have traditionally focussed on the undeniable links to shifts in interest rates: Optimal pre-payments occur when rational borrowers take advantage of favourable shifts in the prevailing market rates, and are inherently forecastable. Much harder to capture are the sub-optimal drivers; death, divorce and a multitude of other unanticipated life events that can trigger pre-payments, none of which are linked to the path of interest rates. This dichotomy is cited as the lead cause of the divergence between implied and observed rates and has led to the development of more complete models of prepayment behaviour.

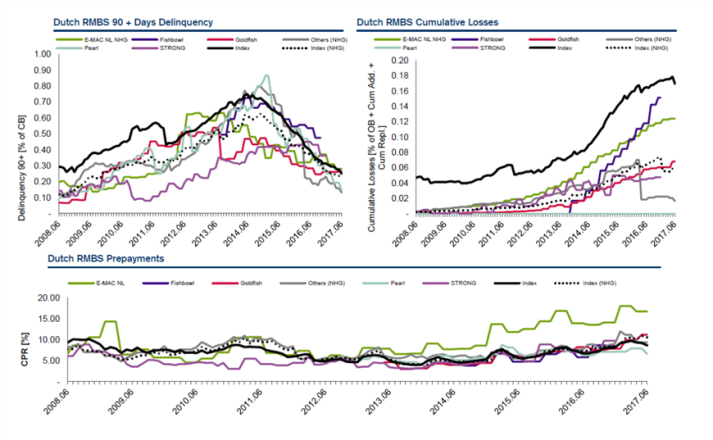

There’s a notorious paucity of publically available data on observed levels of ABS prepayment. However a snapshot of the Dutch RMBS market over the past decade can serve as a suitable market proxy:

The data supports the shifting nature of risk within RMBS investment, with delinquencies in decline since their cyclical peak in 2014. Reciprocally, observed levels of prepayment have steadily increased over the same period. In aggregate, RMBS losses are on the rise which correlates to suggest that market is struggling to price in the dynamics of prepayment risk.

Clearly, investors now face different challenges in appraising RMBS investment opportunities in the current market cycle. Governments and regulators have indeed doubled down on ensuring that credit risk is mitigated via, amongst other steps, rigorous risk analysis. However, it would appear more work needs to be done to illuminate the nature of prepayment risk for institutional investors. Whilst the modelling challenge should not be underestimated, with the appropriate tools, investors can better equip themselves to seek the optimal risk-adjusted outcomes.