In an effort to improve investment returns, many financial institutions are implementing more sophisticated trading strategies involving diverse asset classes, like mortgage-backed securities (MBS). But because MBS have unique characteristics, they create modeling challenges for many firms.

To delve into these challenges and offer ways to overcome them, FINCAD recently held a webinar, “MBS Best Practices for Multi-Asset Strategies.” FINCAD’s Eric Peng, Manager, Quantitative Framework, and Eknath Belbase, Director of MBS Strategy at Andrew Davidson & Co., co-hosted the event.

One primary area where firms struggle is in building a complete analytics system for MBS. This can be due to a few different factors, including a lack of expertise in MBS modeling, the high costs and time investment that go into acquiring and marshalling the necessary data, and the fact that calculations involved in MBS analysis are complex, leaving firms’ systems unable to cope efficiently.

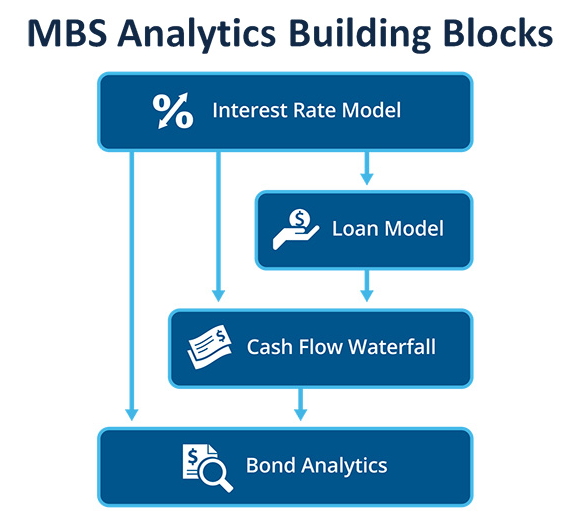

To combat these challenges while minimizing the associated costs, many firms are electing to implement a generic, modular approach to MBS analytics. By this I mean they are designing their MBS analytics framework by first identifying the fundamental concepts in their analysis workflow. From there, they use these concepts as building blocks that combine to form a complete MBS analytics system.

Below gives an example of the components of such a framework:

- Interest Rate Model: The interest rate model produces simulated paths of future interest rates. Such a model generally takes inputs such as the current term structure and some model-specific parameters, which are typically determined by calibration to quotes of market instruments.

- Loan Model: The loan model is a concept that embodies the modeling assumptions for the dynamics of the loans backing an MBS, which include prepayment, defaults and loss severities. The arrow in the below diagram pointing from the interest rate model to the loan model depicts the flow of information, indicating that the rates scenarios generated by the interest rate model act as inputs to the loan model that drive, for example, prepayment behavior. Broadly speaking, lower levels of interest rates lead to higher prepayment speeds by incentivizing mortgage refinancing.

- Cash Flow Waterfall: With the necessary modeling in place, we can now shift attention to the definition of the mortgage-backed security itself. As shown in the diagram, we call the object that encodes the cash flow distribution rules of an MBS deal, the cash flow waterfall. Rates generated by the interest rate model may be needed by the cash flow waterfall directly if floating rate securities are present. At the very least, prepayment rates, default rates, and loss severities produced by the loan model are consumed by the cash flow waterfall. The waterfall then outputs the corresponding cash flows of the MBS in question. The complexity of the cash flow waterfall can range from straightforward agency fixed-rate pass-throughs, all the way to collateralized mortgage obligations with multiple tranches that cover the spectrum of payoff types.

- Bond Analytics: Finally, we need analytics capable of performing the desired calculations that inform portfolio management decisions. The block labeled “bond analytics” in the diagram represents the set of calculators that take cash flows generated by the cash flow waterfall, as well as interest rate information, and output results. For example, in the bond analytics part of this framework, one might need analytics that compute relative value measures such as OAS and Z-spread, or valuation and risk engines that calculate quantities like duration, convexity and value at risk (VaR).

This MBS framework design is generic and flexible enough to support any kind of MBS analysis that you might want to carry out. Each module in the framework can be swapped out and replaced as desired, without affecting the other parts of the system. This allows you to focus on areas where value creation is greatest.

For instance, a firm may believe they have an edge in accurately forecasting prepayment and modeling interest rates. Under this framework, they are able to concentrate efforts on developing the loan model and interest rate model, while taking advantage of providers that specialize in cash flow modeling and bond analytics solutions. Furthermore, making updates to the framework in light of new target trades or innovations in modeling can now be executed much more efficiently, as each component in the diagram can be modified without breaking the coherence of the workflow.

In essence, managing MBS is challenging in that there are many potential pitfalls that can lead to losses due to inaccurate valuation and hedging. The most reliable way to guard against these dangers is to ensure your analytics system is built on a generic framework that is consistent in its handling of all trades and portfolios, MBS included. Full consistency combined with a granular view of risk, another hallmark of such a system, will significantly decrease blind spots in your risk management program and hidden drains on P&L.

Watch the on-demand webinar: MBS Best Practices for Multi-Asset Strategies for more information about MBS modeling.