It’s no secret that mortgage-backed securities (MBS) have become a safer investment than they were in the years immediately following the crisis. Today investors are adopting more sophisticated trading strategies involving complex investments like MBS, and are generating significantly better returns in the process.

However, because MBS are unique and complex instruments, often market participants struggle with modeling them. As far as what term structure model to use for MBS, there is no single gold standard. You first need to consider whether your portfolio is purely MBS focused, or if you have both MBS and hedging instruments in the same portfolio. The LIBOR Market Model is popular among those with balanced books where there are hedges, swaps and swaptions. Whereas for purely MBS focused participants, a Hull-White model is commonly used.

What’s most important is not the model you pick for MBS, but rather whether you are using the same modeling framework consistently across all securities in your portfolio. This is particularly true if you have MBS as part of your broader fixed income portfolio and you want to value and risk manage that portfolio in a holistic fashion. For valuation purposes, the value of being consistent shows up in your risk profiles and your exposures. Lack of consistency can have a big impact on hedge ratios. You may unknowingly be introducing risk into your hedging process by not paying attention to the kind of modeling assumptions you are making for your multi-asset portfolio.

Because MBS do introduce these specialized considerations, some firms may shy away from them. Often firms will struggle with building the complete MBS analytics system they need to cover all aspects of analytical demands. They find this task challenging due to a few different factors, including:

- a lack of expertise in MBS modeling,

- the high costs and time investment that go into acquiring and marshalling the necessary data,

- and the fact that calculations involved in MBS analysis are complex, leaving firms’ systems unable to cope efficiently.

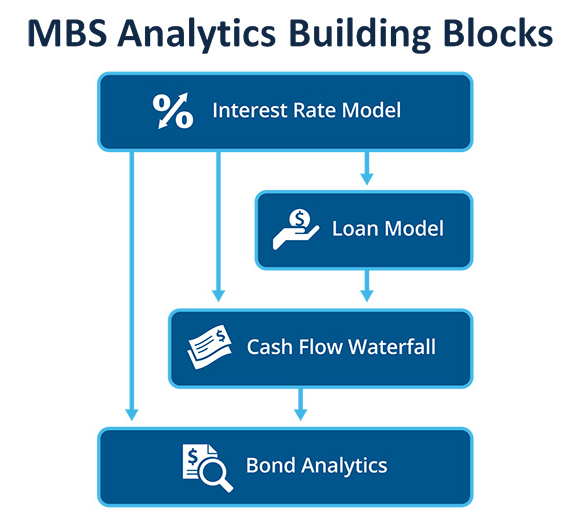

To overcome these challenges while minimizing the associated costs, many firms are electing to implement a generic, modular approach to MBS analytics. To accomplish this, they are designing their MBS analytics framework by first identifying the fundamental concepts in their analysis workflow. From there, they use these concepts as building blocks that combine to form a complete MBS analytics system. A sample framework might include the following components:

- Interest Rate Model: The interest rate model produces simulated paths of future interest rates. Such a model generally takes inputs such as the current term structure and some model-specific parameters, which are typically determined by calibration to quotes of market instruments.

- Loan Model: The loan model is a concept that embodies the modeling assumptions for the dynamics of the loans backing an MBS, which include prepayment, defaults and loss severities.

- Cash Flow Waterfall: With the necessary modeling in place, you can shift your attention to the definition of the mortgage-backed security itself. The complexity of the cash flow waterfall can range from straightforward agency fixed-rate pass-throughs, all the way to collateralized mortgage obligations with multiple tranches that cover the spectrum of payoff types.

- Bond Analytics: Finally, we need analytics capable of performing the desired calculations that inform portfolio management decisions.

This MBS framework design is generic and flexible enough to support any kind of MBS analysis that you want to carry out. Each module in the framework can be swapped out and replaced as desired, without affecting the other parts of the system. Making updates to the framework in light of new target trades or innovations in modeling can be executed efficiently, as each component in the diagram can be modified individually without breaking the coherence of the workflow.

As I stated earlier in this post, it’s not the model you use that will determine your success with MBS, but more so how consistent you are with modeling across all the assets in your portfolio. With MBS, as with any complex investment type, there are potential pitfalls related to inaccurate valuation and hedging that can lead to losses. To guard against these dangers, ensure your analytics system is built on a generic framework that is consistent in its handling of all trades and portfolios, MBS included. Full consistency combined with a granular view of risk will significantly decrease blind spots in your risk management program and hidden drains on P&L.

For more information on MBS modeling, check out our eBook: Best Practices in MBS Valuation and Risk