Let’s face it. Despite the recent rise in the markets, the economic climate continues to be difficult. This reality is moving buy side firms to explore new investment arenas and technologies that deliver clear benefits.

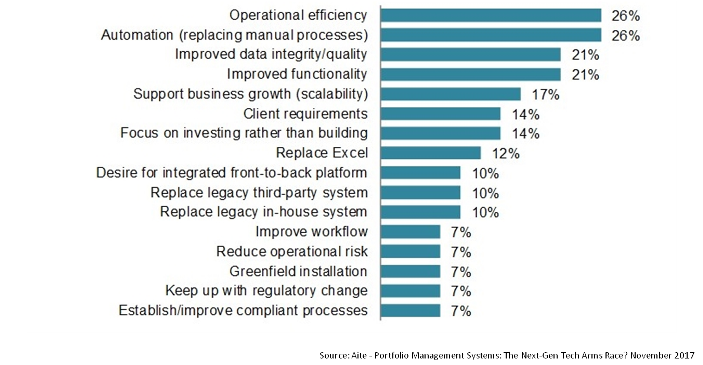

One way top-performing buy side firms are achieving their goals is by phasing out inflexible legacy systems in favor of one integrated system for portfolio and risk analytics. Recent Aite research provides insight into this trend. As indicated in the graph below, the top three areas driving firms to seek out integrated portfolio management systems include desires to:

- Improve operational efficiency (26%)

- Automate/ replace manual processes (26%)

- Improve data integrity/quality (21%)

Investment Drivers for Portfolio Management Systems

A major advantage of best-in-class portfolio and risk analytics systems is that they fit nicely into organizations’ established trading and operations workflows. Firms will typically have front-office OMS/EMS matching systems, as seen on the top of the diagram below, and operations, accounting and reporting systems as seen at the bottom of the diagram. In between those two arrows at the top and bottom of the diagram fit the portfolio management and risk systems. Here, what has started as a simple picture becomes more complex, as firms deal with needs to:

- enter new products, markets and asset classes in the search for alpha,

- modify their systems to meet shifting business requirements,

- meet emerging requirements for regulations such as MiFID II, Basel III and others,

- and do bespoke portfolio analysis for optimization or back-testing, and managing margin, collateral and xVA.

Portfolio Management & Risk Systems Landscape

Firms have addressed these emerging requirements in a variety of ways, including in-house developments, spreadsheets, Python, and multiple analytics libraries. What this has created is a patchwork of systems for portfolio and risk analytics. The problem is that use of this messy patchwork leads to inconsistent data and analytics, and makes it challenging to effectively collaborate across organizational teams.

One of the key ways the patchwork challenge manifests itself is that it increases the burden of manual tasks, which of course has a negative impact on costs and efficiency. In fact, results of a recent survey from the collaboration software provider, Confluence, demonstrate the increased uneasiness firms are feeling over manual processes and spreadsheets that result from a patchwork approach. In the Confluence Asset Management Trend Survey Report Q4 2017, 84% of firms reported being concerned to extremely concerned about how manual processes and spreadsheets are affecting their ability to control costs.

Out with the Old…In with the New

By abandoning the patchwork approach to systems and instead adopting one integrated solution for portfolio and risk analytics, firms can achieve increased collaboration, improved data quality and integrity, and reduced operational risk.

For instance, using a best-in-class portfolio and risk analytics solution, users have the option to use Python for the more sophisticated, bespoke analytics. Then, often a combination of the solution’s GUI for portfolio and risk analytics of more standardized products can be used, while complex products are handled using Excel integrated with a platform. Analytics can also be integrated so the team is able to pull more systems into their standard set of data and analytics.

Where prior there was a patchwork approach, now there is a solution integrated into the technology ecosystem. That integration is key because without it your workflow will suffer. However, those that get it right will be able to move to the high-speed, streamlined world of integrated portfolio and risk analytics. Doing so brings clear benefits in the form of:

- improved collaboration,

- better data quality and integrity,

- reduced operational risk,

- decreased reconciliation issues,

- and diminished manual processes.

The cumulative advantage of these benefits is dramatically improved business efficiency that will empower your firm to take your business in any direction you choose.

For more information on this topic, watch our on-demand webinar: Turbocharge Your Valuation and Risk Technology