Buy side institutions are learning that the trend of today is multi-asset trading. The firms that are successfully generating alpha in the current climate are the ones adopting more sophisticated trading strategies, involving complex instruments.

“The buy side continues the move to multi-asset trading to manage increasingly diversified portfolios, find liquidity, and reduce volatility. This requires systems that are easy to integrate, allow a high degree of customization, and can support a wide range of asset classes and products,” stated Kevin McPartland, Managing Director, Market Structure and Technology at Greenwich Associates.

While expansion into new, diverse asset classes may seem a straightforward enough concept, the majority of buy side firms struggle as their legacy valuation and risk systems were simply not designed with a multi-asset world in mind. And, many times, their technology is holding them back in other critical ways. In fact, many firms we speak to also find it difficult to meet business requirements for handling large, complex portfolios and changes in processing demands.

This reality is moving more buy sides to abandon legacy systems in favor of high-performance enterprise technology offering advanced tools and analytics for portfolio and risk management. Such technology is equipping firms with the freedom to trade what they want, when they want and where they want, all while offering improved performance, scalability and a lower cost of ownership.

Below I’ll explore two of the most common buy side technology challenges firms face, which are making it harder for them to generate good returns. I’ll also give real-world examples of how using enterprise technology can help your firm overcome these issues.

Challenge #1: Inability to Price Complex Instruments

In search of greater revenue opportunities, many firms are adopting trading strategies that involve complex instruments. However, they are challenged by pricing these products using Excel, as the tool slows down under the weight of heavy computational demands. Furthermore, because Excel is a single-threaded tool, it is incapable of performing such calculations as Monte Carlo simulations in parallel. This makes pricing large-sized portfolios very time-intensive. In essence, what this all means is that no one individual in an organization has enough power on their local platform to perform complex calculations in the timeframe needed to close deals quickly.

Real-World Scenario: Our hypothetical trader, Anne, gets a call from Bob, her regular client. Bob has a special request for her.

Anne: Hi Bob…What’s up?

Bob: Hi Anne, I’d like to buy ten distinct callable bonds. This is kind of urgent, so can you get back to me with a quote in 15 minutes?

Anne: Sure I can get you a price…but 15 minutes? That’s a bit tight. I’ll see what I can do.

Anne is worried that she will be unable to handle her client’s request, and may risk the relationship. Because callable bonds are notoriously computationally expensive, the task of pricing ten of them will be time-consuming in Excel. On top of that, Anne will still need to check her risk limits with Justin, her risk manager, in order to confirm that she can even take the trade.

Solution: Speed Up Computationally Intensive Valuations

Anne could have avoided difficulty in fulfilling her client’s request if she had been using a high-performance portfolio and risk management solution. Such technology allows firms to scale on-demand, as it makes sense to do so. This way, users are not restricted by their local hardware, and therefore are not limited in their ability to do business. For example, the FINCAD F3 enterprise portfolio and risk management solution allows you to add a set of calculation managers and engines on the fly, creating two places for requests to be forwarded. This doubles the scale of your system without downtime. Outstanding portfolios can then be priced in parallel, helping you close profitable deals faster, and thereby boosting your ability to generate good returns.

Challenge #2: Handling Fluctuations in Processing Demands

Many buy side organizations are challenged by the need to handle fluctuations in processing demands on their trading systems. Often the addition of hardware, such as a new server, is used to address the fluctuation, however what this also means is that significant systems redesigning and recoding also needs to occur. This results in downtime and unnecessary costs that make it harder to be profitable. Consider the following scenario demonstrating how the need for constant recoding can present issues for a firm.

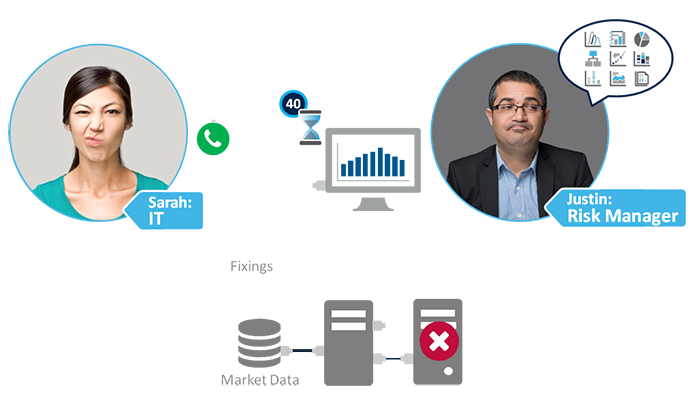

Real-World Scenario: After the close of business, Risk Manager, Justin prepares to kick off his end of day job, running the risk report. As usual, he has Sarah from IT on the phone for backup in case anything breaks.

Justin: The risk job is going to run for 40 minutes on the server. Cross your fingers that everything goes well or we’ll miss the SLA’s.

Sarah: Justin, I’ve always wondered, why don’t we add another server for this?

Justin: I’ve considered that option, but the software we have for end-of-day is not going to automatically scale. So adding a new server will not help anything.

Here the challenge is that Justin has an end-of-day software that requires significant rewriting to take advantage of two servers. This is because the software is neither scalable nor distributed. So, even though Justin has the funds available to add a new server, it doesn’t make sense for him to do so.

Solution: Establish Enterprise Scalability

To achieve enterprise-wide scalability, firms need access to a flexible portfolio and risk management technology based on generic architecture, allowing them to easily tack-on hardware as necessary. This approach can foster better capacity planning, as firms will be able to quickly and easily scale their technology as needed to accommodate an uptick in demand, such as, for example, the need to value large numbers of portfolios simultaneously. Organizations that adopt solutions designed to scale on demand typically experience immediate cost savings, improved profitability and an overall lower cost of ownership when stacked up against the traditional approach of having to buy a new server or redesign software to cope with changes in processing volume.

Embracing High-Performance Technology

It’s worth noting that F3, FINCAD’s enterprise portfolio and risk management solution, has helped numerous firms achieve scalability across the enterprise, and dramatically speed up valuations of vanilla through to exotic instruments— enabling them to generate superior returns. What’s more, recent enhancements made to the solution, including the addition of a market data connector and trade and security master integration, enable firms to accelerate their time to production.

Like to learn more about overcoming key buy side technology challenges? Read our related eBook: How to Drive Competitive Advantage with Trading and Risk Enterprise Architecture