Thin investment returns, shifting regulations, and tight operating margins are serious factors that are driving buy-side firms to modernize their investment technology to stay competitive. These firms’ major obstacles to growth include error prone spreadsheets, inflexible in-house software and disparate legacy systems.

How to deal with these challenges, while simultaneously promoting growth, forms the basis of our newly released eBook: Turbocharge Your Valuation and Risk Technology. In the eBook, you’ll discover how many top-performing buy-side firms are:

- Enhancing performance and responding faster to market opportunities using flexible technology

- Optimizing and managing multi-asset portfolios with configurable portfolio analytics and risk reports

- Aligning the front and middle office, and minimizing operational risk with a centralized valuation and risk platform

As asset managers work to overcome their biggest market and business-related challenges, they are looking to upgrade their technology for help. Instead of developing in-house, increasingly firms are deciding to source their upgraded technology from third-party software providers. Why? Well most are realizing that the cost of building in-house is high and maintaining those systems in-house is even higher— and really an unnecessary expenditure.

The great thing about knowledgeable third-party providers is that typically their system offerings can be tailored to an individual firm’s investment style, approach and workflow. In fact, now there are some best-of-breed providers offering advanced technology that is highly flexible, infinitely customizable and enables you to deploy quickly. Additionally, working with a vendor that has specialized experience in the industry can really be an ace in your pocket in terms of keeping up with changes in business and market practices, and compliance.

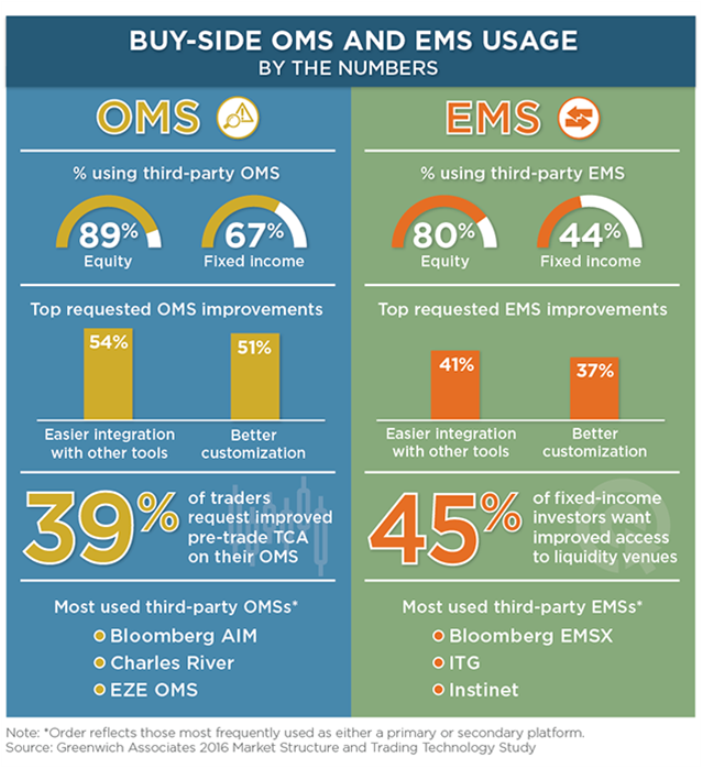

It’s therefore not surprising that research from Greenwich Associates shows the trend of firms using third-party software on the trading desk is growing in popularity. This trend can partly be attributed to access to the cloud, which has enabled many buy-side firms to use tools they wouldn’t have been able to use before. Vendor-offered cloud deployments have provided these firms with nearly unlimited computing power necessary to running complex models without the capital expense of operating a data-center.

The below infographic, courtesy of Greenwich Associates, puts things into good perspective. Looking at the equities market where they are a bit more advanced in their technology usage, nearly 90% of firms reported using an OMS from a third-party. There is large emphasis on systems offering strong data and analytics that enable firms to improve pricing and risk management. This information is critical because the fixed income markets are opaque compared to many exchange-traded markets. Also as shown in the infographic, a leading demand of firms is that third-party systems be easier to integrate with existing data, systems and workflows. Fortunately, over the last several years, several providers have adapted their technology approach to meet this demand.

The reality is that many buy-side firms that have adopted third-party portfolio and risk analytics solutions are experiencing excellent results. These come in the form of:

- improved collaboration,

- better data quality and integrity,

- reduced operational risk,

- decreased reconciliation issues,

- and diminished manual processes.

The cumulative advantage of all of these benefits is dramatically improved business efficiency that will empower you to take your business in any direction you choose. For more on this topic, check out the new eBook: Turbocharge Your Valuation and Risk Technology