As a buy- or sell-side firm, you may not be thinking about some of the more detailed aspects of managing your investment portfolio, like for example, how your trade calendar and particularly holidays are treated in your analytics system. But the truth is that getting holiday conventions right is crucially important to helping you accurately price trades.

The traditional process financial institutions take to setting up calendars in their trading systems usually consists of obtaining a list of holiday observances from a relevant data provider. The dates should at least go back to around 1980 and forward beyond 2100. Then the firm’s developers or other technical professionals must go into the code of their systems and add the calendar data. And because different markets and regions will observe different holidays, you may have to repeat this process several times over. Not only does this require significant effort on the part of your employees, it also means your systems are carrying around a lot of extra data, which can potentially negatively impact their performance. Other firms may not have the staffing bandwidth to handle calendar setup and maintenance internally. They opt to outsource it, but, for many this becomes an unnecessary expense.

The great thing about modern analytics solutions is that you get all the common holidays from all the major financial centers already set up for you as rules providing the capability to query whether a given date is a holiday or not, instead of merely a long scroll of dates that you have to input yourself. This approach saves users a tremendous amount of time and eliminates performance concerns related to high data usage. It also helps you move more agilely into new markets that others may not have yet explored. Below I will give three specific examples of how handling holiday conventions using set theory in your analytics solution can be highly beneficial.

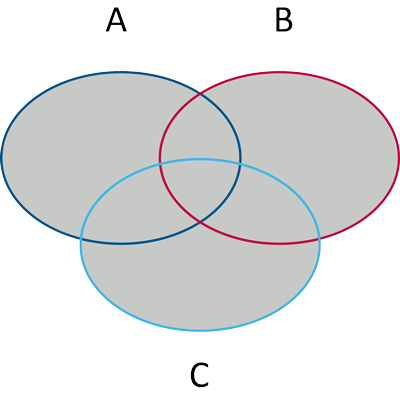

Need to Reference Multiple Calendars Simultaneously: Say you are a London-based trader that wants to perform an FX trade whereby you are converting British pounds sterling (GBP) to Mexican Pesos (MXN). In order to do this, you not only need to consider the London and Mexico CIty financial calendars, but also the New York calendar. This is because the FX trade will need to be cleared in US dollars before it is converted into Pesos. The union of all three financial calendars in this scenario is illustrated in the Venn diagram at right. With a sophisticated analytics solution like FINCAD’s F3 Platform, there is no need to spend time poring over the three financial calendars to determine what will be a good business day in all locations to perform your trade. The system is designed to do this for you automatically once you indicate the need for it to reference all three holiday calendars as a rule.

Need to Reference Multiple Calendars Simultaneously: Say you are a London-based trader that wants to perform an FX trade whereby you are converting British pounds sterling (GBP) to Mexican Pesos (MXN). In order to do this, you not only need to consider the London and Mexico CIty financial calendars, but also the New York calendar. This is because the FX trade will need to be cleared in US dollars before it is converted into Pesos. The union of all three financial calendars in this scenario is illustrated in the Venn diagram at right. With a sophisticated analytics solution like FINCAD’s F3 Platform, there is no need to spend time poring over the three financial calendars to determine what will be a good business day in all locations to perform your trade. The system is designed to do this for you automatically once you indicate the need for it to reference all three holiday calendars as a rule.

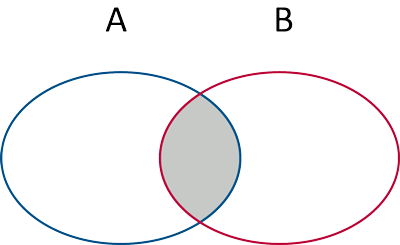

Conflicting Holiday Observances within a Country: If you are executing a trade domestically, you may think you only need to concern yourself with one financial calendar. But, if you are trading in someplace like the New Zealand market, you’ll find that its various cities have different holiday observances. Auckland and Wellington are two examples of these. In this case, you may want to identify the intersection of the two holiday calendars of Auckland and Wellington to understand when both markets are closed simultaneously. A modern analytics solution allows you to easily set up this logic once, so you don’t need to worry about it going forward.

Conflicting Holiday Observances within a Country: If you are executing a trade domestically, you may think you only need to concern yourself with one financial calendar. But, if you are trading in someplace like the New Zealand market, you’ll find that its various cities have different holiday observances. Auckland and Wellington are two examples of these. In this case, you may want to identify the intersection of the two holiday calendars of Auckland and Wellington to understand when both markets are closed simultaneously. A modern analytics solution allows you to easily set up this logic once, so you don’t need to worry about it going forward.

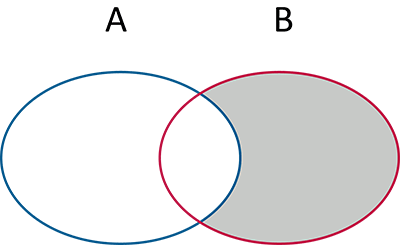

Handling Partial Holidays: While typically a market will be either opened or closed on any given day, some financial centers observe partial holidays. It is therefore up to the firm if they want to count such a day as a holiday or not. For instance, in Brazil, New Year’s Eve is considered a national holiday, but in reality the exchange is opened for a few hours that day. We have a client based there that uses our F3 Platform. We easily customized a rule for them that reflected New Year’s Eve as a working day. Such rules can be published to F3 Platform and shared with all users, leading to consistent firm-wide reference data that is easy to maintain.In essence, a modern analytics solution, like FINCAD’s F3 Platform, simplifies the process of doing business both with firms based in your own region and across borders or markets. Instead of needing to spend countless hours entering holiday data related to all the markets or currencies that you trade, with F3 you can set up calendar rules once and they will be good for all time (or until you elect to change them). With one less thing to worry about, you can then stay focused on developing new trading strategies and other high-level initiatives that drive your firm’s profitability and competitive advantage.

Handling Partial Holidays: While typically a market will be either opened or closed on any given day, some financial centers observe partial holidays. It is therefore up to the firm if they want to count such a day as a holiday or not. For instance, in Brazil, New Year’s Eve is considered a national holiday, but in reality the exchange is opened for a few hours that day. We have a client based there that uses our F3 Platform. We easily customized a rule for them that reflected New Year’s Eve as a working day. Such rules can be published to F3 Platform and shared with all users, leading to consistent firm-wide reference data that is easy to maintain.In essence, a modern analytics solution, like FINCAD’s F3 Platform, simplifies the process of doing business both with firms based in your own region and across borders or markets. Instead of needing to spend countless hours entering holiday data related to all the markets or currencies that you trade, with F3 you can set up calendar rules once and they will be good for all time (or until you elect to change them). With one less thing to worry about, you can then stay focused on developing new trading strategies and other high-level initiatives that drive your firm’s profitability and competitive advantage.

For information on additional ways a modern analytics solution like FINCAD’s F3 Platform can help you improve trading performance, listen to our on-demand webinar: How to Drive Business Value with High-Performance Architecture